Forex Day Trading: Strategies and Tips for Success

Forex day trading is a popular trading strategy that entails buying and selling currency pairs within a single trading day, making it essential for traders to have a solid understanding of market dynamics and risk management. As a trader, it is crucial to be informed and prepared. In this article, we will delve into the strategies and techniques that can help you in your forex day trading journey. In addition, we will introduce you to resources such as forex day trading ZAR Trading that can amplify your trading experience.

Understanding Forex Day Trading

Forex day trading is characterized by its fast-paced nature. Unlike long-term trading strategies, day traders aim to capitalize on small price movements throughout the day. This approach requires an in-depth knowledge of the forex market, as well as a disciplined mindset. Traders rely on a combination of technical analysis, chart patterns, and market news to make informed decisions.

Key Strategies for Successful Forex Day Trading

1. Develop a Trading Plan

A well-defined trading plan is the foundation of successful day trading. Your plan should outline your trading goals, risk tolerance, entry and exit strategies, and rules for managing your positions. It should also include specific criteria for selecting currency pairs to trade.

2. Utilize Technical Analysis

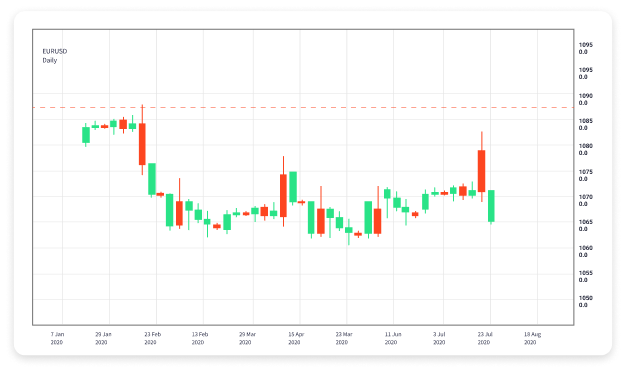

Technical analysis involves analyzing price charts and patterns to predict future movements in the currency market. Day traders often use indicators such as moving averages, MACD, and RSI to identify potential trade opportunities. Chart patterns, such as flags, triangles, and head-and-shoulders, can also provide valuable information regarding market direction.

3. Manage Risks Effectively

Risk management is integral to successful trading. As a day trader, you should never risk more than a small percentage of your trading account on any single trade. A common rule is to risk no more than 1% to 2% of your account balance. Use stop-loss orders to limit potential losses and protect your capital.

4. Keep an Eye on Economic News

Economic news and data releases can have a significant impact on currency prices. As a day trader, it is essential to stay informed about upcoming economic events that could affect the market. Consider using an economic calendar to track scheduled announcements, such as interest rate decisions or employment reports.

5. Choose the Right Currency Pairs

Not all currency pairs are suitable for day trading. It’s important to select pairs with good liquidity, as this ensures that you can enter and exit trades easily and with minimal slippage. Major pairs, such as EUR/USD, GBP/USD, and USD/JPY, are often preferred by day traders due to their high trading volumes.

The Importance of Discipline and Psychology in Day Trading

Successful day trading requires not only a solid strategy but also mental fortitude. Emotional trading can lead to impulsive decisions, resulting in losses. To navigate the psychological challenges of forex day trading, consider the following:

1. Stay Disciplined

Stick to your trading plan and avoid deviating from your predefined rules. Discipline is key to maintaining consistency and achieving success in day trading.

2. Control Your Emotions

Fear and greed can cloud your judgment. Develop techniques to manage your emotions, such as taking breaks during trading sessions or practicing mindfulness.

3. Learn from Mistakes

Every trader experiences losses. Instead of dwelling on your mistakes, analyze what went wrong and how you can improve in the future. Keeping a trading journal can help you track your progress and identify areas for improvement.

Tools and Resources for Forex Day Trading

Utilizing the right tools can significantly enhance your day trading experience. Here are some essential resources that could help you along the way:

1. Trading Platforms

Select a reliable trading platform that offers real-time data, advanced charting capabilities, and a user-friendly interface. Several platforms offer demo accounts that allow you to practice trading without risking real money.

2. Market Analysis Software

Market analysis software can assist in technical analysis and provide insights into market trends. These tools can help you make informed decisions based on historical data and analytical reports.

3. Online Communities and Forums

Engaging with other traders in online communities can provide you with valuable insights and different perspectives. Participate in forums to share experiences, ask questions, and learn from others in the forex trading community.

Conclusion

Forex day trading offers a unique opportunity for traders to capitalize on short-term price movements in the currency market. By implementing effective strategies, managing risks, and maintaining discipline, you can enhance your chances of success as a day trader. Remember that continuous learning and adaptation to market changes are essential for long-term profitability. Whether you are a beginner or an experienced trader, resources like ZAR Trading can provide invaluable support in your trading endeavors.