Forex trading, or foreign exchange trading, is the act of buying and selling currency pairs in a global marketplace. It’s important for anyone interested in this field to understand the fundamentals before diving in. This guide provides an overview of the basic concepts and strategies of Forex trading, helping you to build a solid foundation. For more detailed insights and resources, you can visit forex trading basics https://forex-level.com/.

What is Forex Trading?

Forex trading involves the exchange of one currency for another at an agreed price. The currency market is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, allowing traders to participate at any time.

Understanding Currency Pairs

In Forex, currencies are traded in pairs, such as EUR/USD, GBP/JPY, or AUD/CAD. Each pair consists of a base currency and a quote currency. The base currency is the first currency in the pair, while the quote currency is the second. The exchange rate represents how much of the quote currency is needed to purchase one unit of the base currency.

Types of Currency Pairs

- Major Pairs: These pairs include the most traded currencies and typically have the highest liquidity, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: Pairs that do not involve the US dollar but consist of other major currencies, such as EUR/GBP or AUD/NZD.

- Exotic Pairs: These consist of one major currency paired with a currency from a developing economy, like USD/TRY (Turkish Lira) or EUR/ZAR (South African Rand).

How to Start Forex Trading

Getting started in Forex trading requires a clear understanding of several key components. Below are essential steps that will help you begin your Forex journey:

1. Choose a Reliable Forex Broker

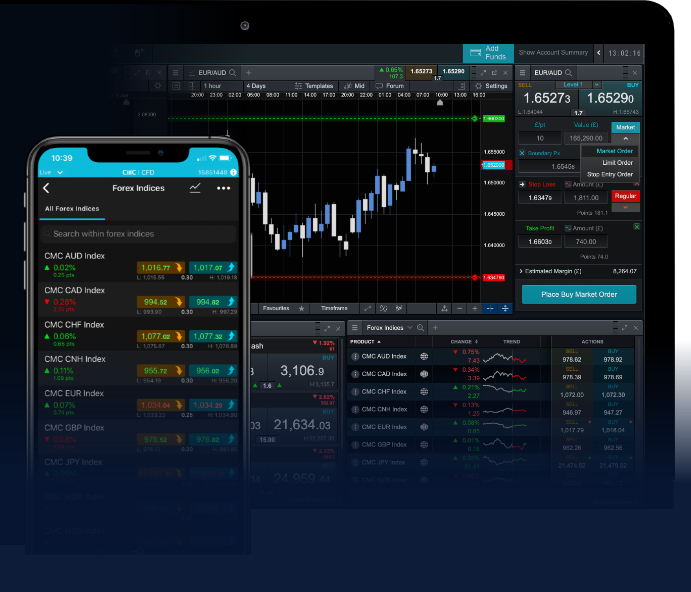

Before trading, you need to select a broker. Look for a broker that is regulated, offers a user-friendly trading platform, and has favorable trading conditions. Check for spreads, commissions, and the availability of customer support.

2. Open a Trading Account

After choosing a broker, you need to open a trading account. Many brokers offer demo accounts, which allow you to practice trading without using real money. This can be a great way to learn the mechanics of trading before committing actual funds.

3. Learn Key Trading Concepts

Familiarize yourself with key trading terms and concepts. Here are some basics:

- Leverage: Allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses.

- Margin: The minimum amount required in your account to open a position.

- Pips: The smallest price movement in a currency pair, usually the fourth decimal place.

- Lot Size: Refers to the size of a trade, with standard lots being 100,000 units of the base currency.

Key Forex Trading Strategies

Developing a trading strategy is crucial for your success in Forex trading. There are several strategies that traders commonly use:

1. Day Trading

This strategy involves buying and selling currencies within the same trading day, taking advantage of small price movements. Day traders close all their positions before the market closes to avoid overnight risks.

2. Swing Trading

Swing traders hold onto their positions for several days or weeks, aiming to profit from larger price swings. This strategy requires less frequent trading and allows traders to take advantage of market volatility over a longer period.

3. Scalping

Scalping is a strategy that involves making numerous trades throughout the day, aiming for small profits on each trade. This requires quick decision-making and execution, as trades are often held for only minutes.

Managing Risks in Forex Trading

Risk management is essential for long-term success in Forex trading. Here are some tips to manage risk effectively:

- Use Stop Loss Orders: Implement stop-loss orders to limit potential losses on a trade.

- Determine Position Size: Decide how much of your capital you are willing to risk on each trade and adjust your position size accordingly.

- Diversify Your Portfolio: Avoid putting all your capital into one trade or currency pair.

- Stay Informed: Keep track of economic news and events that may impact the currency market.

The Importance of Education

Education plays a crucial role in becoming a successful Forex trader. Consider investing time in learning about technical and fundamental analysis, trading psychology, and risk management. There are many resources available online, including courses, webinars, books, and trading forums where you can learn from experienced traders.

Conclusion

Forex trading offers many opportunities for profit but also comes with significant risks. Understanding the basics of the Forex market, developing a solid trading strategy, and implementing effective risk management techniques are essential steps for success. By continually educating yourself and adapting to market conditions, you can increase your chances of becoming a successful Forex trader.