Mastering Day Trading in Forex: Strategies and Tips for Success

Day trading in Forex is an exhilarating yet challenging endeavor that requires a unique blend of analysis, discipline, and market intuition. As a day trader, your objective is to capitalize on small price fluctuations in currency pairs throughout the day. Understanding this dynamic market is essential for any trader, especially those who wish to embrace the full-time lifestyle of a Forex trader. To get started, one must comprehend the basics of Forex trading, the methodologies employed, and the best practices to maximize profitability. When considering trading options, exploring resources such as day trading in forex Best Cambodian Brokers can provide valuable insights and support for your trading journey.

Understanding Forex Day Trading

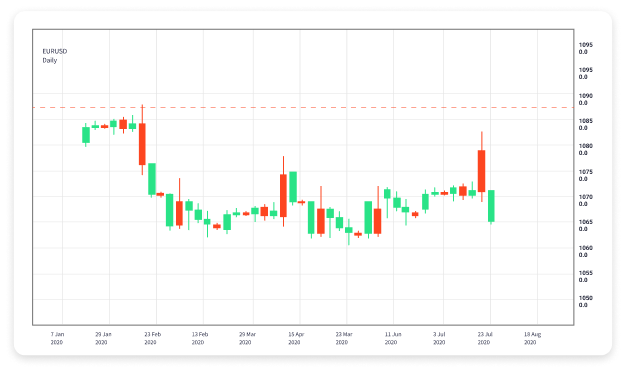

The Forex market is open 24 hours a day, five days a week, allowing traders to react quickly to market movements. Day trading specifically refers to the practice of opening and closing trades within the same day, thus avoiding overnight risks. This approach is heavily dependent on technical analysis, as day traders often utilize charts, indicators, and price patterns to inform their trading decisions.

Key Concepts in Day Trading Forex

1. Currency Pairs

Forex trading involves trading currency pairs, which consist of a base currency and a quote currency. For example, in the EUR/USD pair, the euro is the base currency, and the U.S. dollar is the quote currency. Day traders often focus on the most liquid and volatile pairs to take advantage of price movements, such as EUR/USD, USD/JPY, and GBP/USD.

2. Leverage

Leverage is a double-edged sword in day trading. It allows traders to control a larger position than their initial capital would allow, thereby amplifying potential gains. However, it also magnifies losses, which is why understanding and managing leverage is crucial. Most traders use a leverage ratio of 50:1 or 100:1, but caution is advised.

3. Spread

The spread refers to the difference between the bid and ask price of a currency pair. As a day trader, it’s essential to account for the spread in your trading plan, as it can impact profitability. Tight spreads are often found with major currency pairs, making them preferable for day trading.

4. Volatility

Volatility indicates the degree of price fluctuations within the market. Day traders seek volatile currency pairs because they present more significant opportunities for profit within a limited timeframe. Major economic reports, geopolitical events, and market sentiment can all influence volatility.

Strategies for Day Trading Forex

1. Scalping

Scalping is a popular day trading strategy that involves making numerous trades throughout the day to capture small price movements. Scalpers aim to make quick profits from minor fluctuations, often holding positions for just a few seconds to minutes. This strategy requires a solid understanding of market dynamics and swift execution.

2. Breakout Trading

Breakout trading involves identifying key levels of support and resistance to predict future price movements. When the price breaks above resistance or below support, day traders typically enter a position with the expectation that the trend will continue. This strategy necessitates vigilance and the ability to react quickly to market changes.

3. Range Trading

Range trading focuses on identifying the high and low boundaries of a price range. The trader will buy at the support level (bottom of the range) and sell at the resistance level (top of the range). Successful range trading requires patience and a keen eye for potential reversals within the established limits.

Risk Management in Day Trading

Effective risk management is paramount in day trading, as it protects your capital from significant losses. Here are some key practices:

- Set a Stop Loss: A stop-loss order is an automatic order to close a position when it reaches a certain level, which helps to limit potential losses.

- Define Risk per Trade: Most traders recommend risking no more than 1-2% of your trading capital on any single trade to preserve your account balance over the long term.

- Keep Emotions in Check: Emotional decision-making can lead to significant losses. Discipline and sticking to a trading plan are essential to maintain consistency.

Tools and Platforms for Day Trading Forex

Utilizing the right tools is crucial for successful day trading. Most traders rely on trading platforms that provide advanced charting tools, technical indicators, and real-time market data. Some popular platforms include MetaTrader 4 and 5, TradingView, and Thinkorswim.

Conclusion

Day trading in Forex can be a rewarding venture for those who approach it with the right mindset and tools. By understanding the fundamentals of the Forex market, employing effective strategies, and managing risk, traders can enhance their chances of success. Continuous learning and adapting to market conditions are key to thriving as a Forex day trader. With dedication and practice, you can navigate the fast-paced world of Forex trading and achieve your financial goals.